Managing personal finances is crucial for maintaining financial stability and achieving financial goals. In today’s digital age, various tools and applications are available to assist individuals in tracking and managing their money effectively. One such tool is MoneyManager, a user-friendly app designed to simplify financial management. In this article, we will provide a comprehensive guide on how to use MoneyManager effectively.

I. Getting Started with MoneyManager:

- Download and Install: Start by downloading the MoneyManager app from your device’s app store. Once downloaded, follow the installation instructions to set it up on your device.

- Create an Account: Launch the app and sign up for a new account. Provide the required information, such as your name, email address, and password. Some apps may require additional information for security purposes.

- Set Financial Goals: After creating an account, you can set your financial goals within the app. This could include saving for a vacation, paying off debts, or building an emergency fund. Clearly defining your goals will help MoneyManager provide tailored insights and suggestions.

II. Key Features and Functions of MoneyManager:

- Expense Tracking: MoneyManager allows you to track your expenses accurately. Whenever you make a purchase or incur an expense, input the details into the app. Categorize expenses to understand your spending patterns better.

- Budgeting: Create a budget plan within MoneyManager to keep your spending in check. Set limits for different categories, such as groceries, entertainment, or transportation. The app will provide notifications and alerts when you approach or exceed your budget limits.

- Income Management: Track your income sources within MoneyManager. Input your salary, freelance earnings, or any other income streams. This will give you a comprehensive overview of your overall financial picture.

- Bill Payment Reminders: MoneyManager can send reminders for bill payments, ensuring you never miss a due date. Set up alerts for recurring bills, such as utilities, rent, or loan payments. Stay organized and avoid late payment fees.

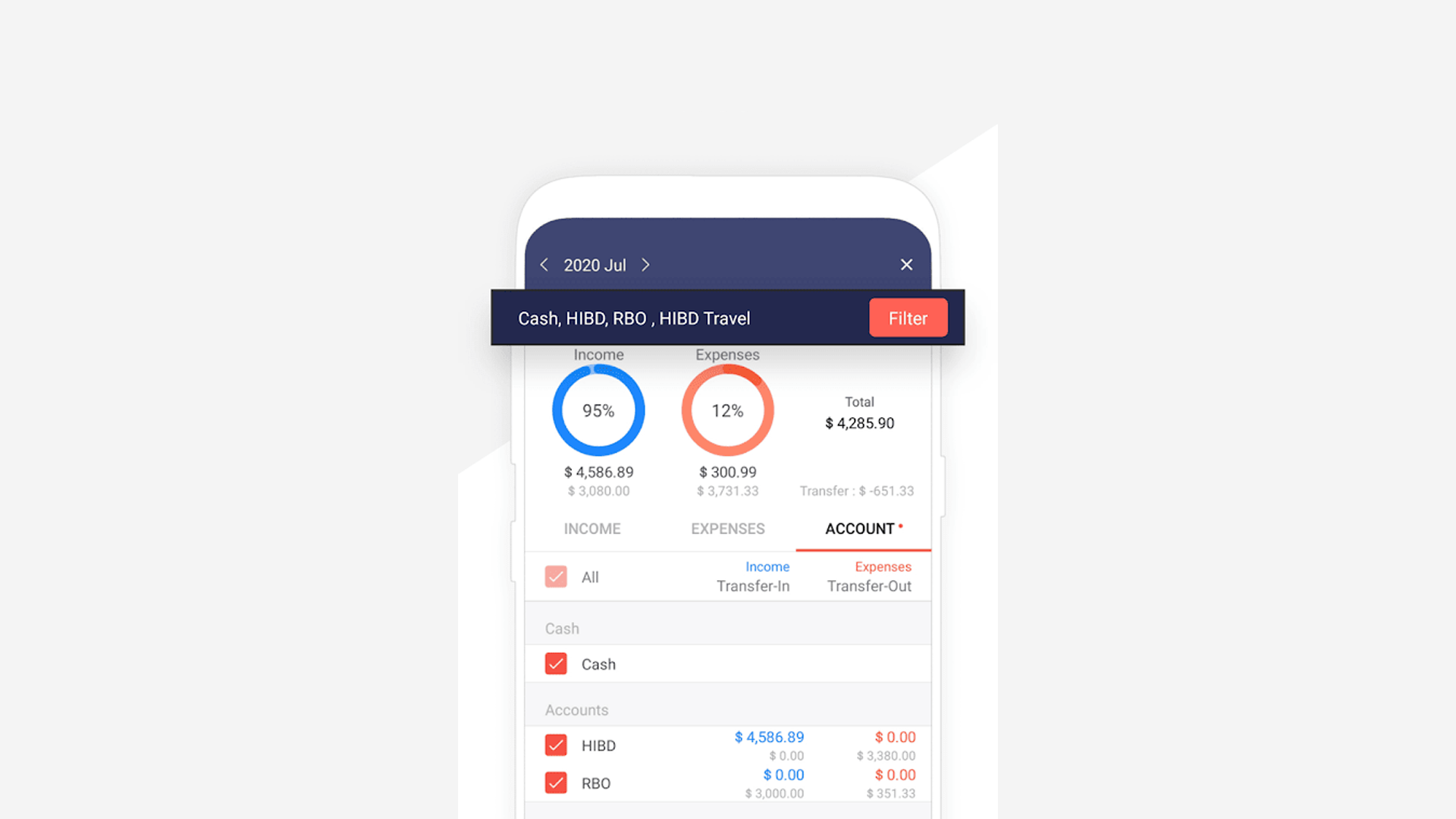

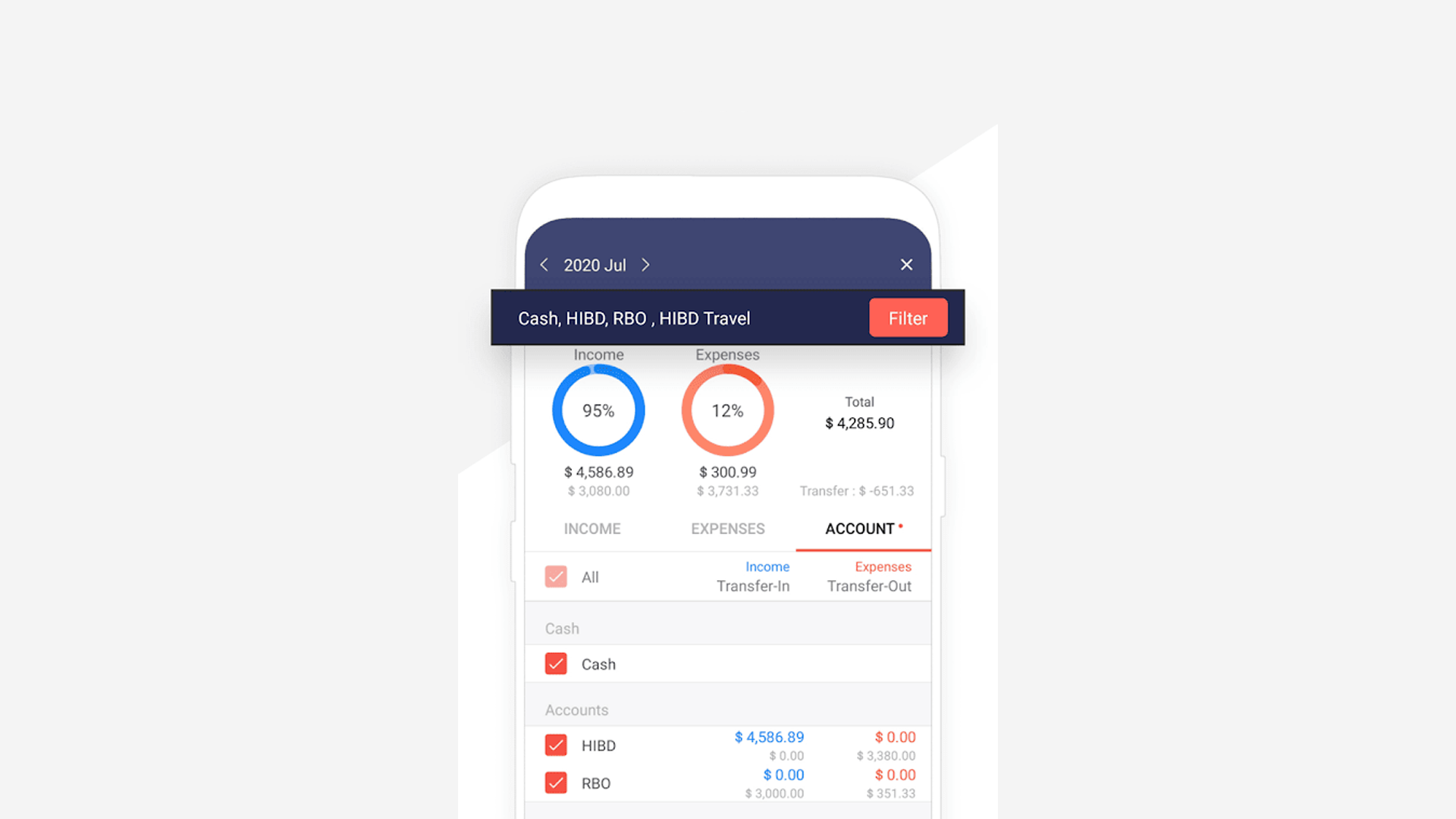

- Financial Reports and Insights: MoneyManager generates detailed reports and insights to help you understand your financial habits. Analyze spending trends, identify areas where you can cut back, and track progress towards your financial goals.

- Savings Goals: Set savings goals within the app and track your progress over time. MoneyManager can provide suggestions on how much to save each month to reach your goals within a specific timeframe.

III. Tips for Maximizing MoneyManager’s Benefits:

- Regularly Update Transactions: To ensure accurate financial tracking, update your transactions regularly. Make it a habit to input your expenses and income as soon as they occur. This will provide you with real-time insights into your finances.

- Review and Adjust Budgets: Periodically review your budget plan and make adjustments as needed. Life circumstances and priorities change, so it’s essential to align your budget with your current needs and financial goals.

- Leverage Automation: Take advantage of automation features within MoneyManager. Link your bank accounts or credit cards to automatically import transactions. This saves time and eliminates the need for manual data entry.

- Utilize Security Features: MoneyManager may offer security features like passcodes or biometric authentication. Enable these features to protect your financial information and maintain data privacy.

Conclusion: MoneyManager is a valuable tool for effectively managing personal finances. By following this comprehensive guide, you can harness the app’s features to track expenses, create budgets, set financial goals, and gain insights into your financial habits. With consistent usage and proactive financial management, MoneyManager can help you achieve greater control over your money and make informed financial decisions.